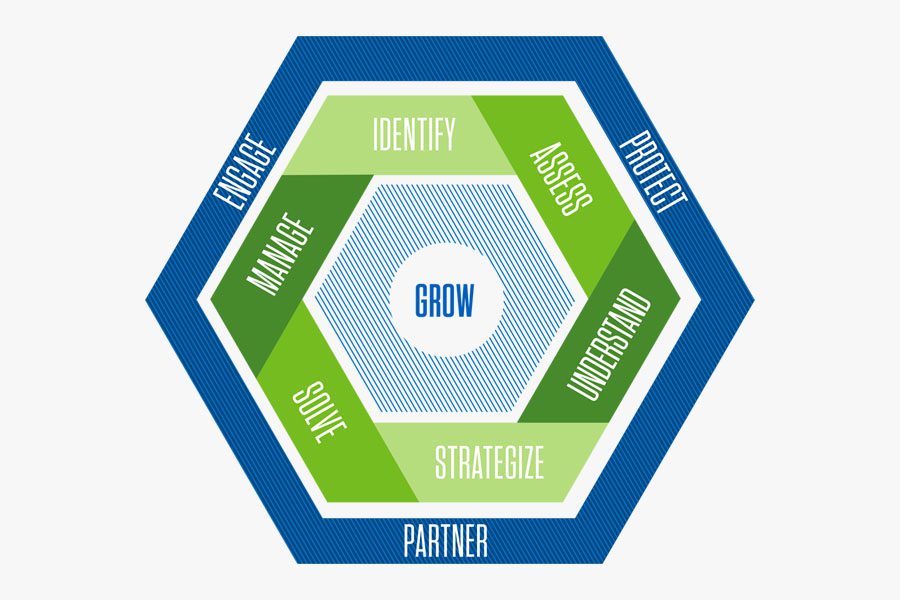

Peel back the layers. Find the drivers. Deliver innovative solutions.

We identify the true drivers of cost and administrative burden.

Home »

Whether it is poorly performing PPO networks, unmanaged pharmacy contracts, black-box fully-insured arrangements, or paper-based HR processes—we have the expertise to help craft a better solution. We do it with software tools that deliver both HR administration and compliance, and strong local teams that average 15 years of industry experience.

Engage Our TeamExplore More Coverages

Our Insurance Specialties

Request Health and Benefits Information

As an independent brokerage, we are here to help you find the right coverage.

Engage Our Team

It only takes a minute to get started.

- Fill out the form, a team member will be in touch.

- Discuss your risk management concerns.

- Learn about available insurance options from an expert.